This website uses cookies for analytics purposes. Learn more

Open Banking: Looking Back & Moving Forward

With Open Banking introduced in the UK over 5 years ago, we look back on the challenges and lessons learned, as well as opportunities for lenders going forward.

A brief history

We are just over 5 years on since the introduction of Open Banking in the UK. Over that time Vestigo have worked with numerous lenders that utilise Open Banking in their decisioning, advising and supporting them with their Open Banking strategies. In this article we will look back on how we have seen lenders use Open Banking, the challenges and lessons learned, and the opportunities going forward.

In the early years of Open Banking, adoption was low, while now most lenders we work with use Open Banking in some form. Similarly, we have seen the use cases evolve over the years, which we will discuss further.

Core use cases

- Open Banking enables accurate real time assessment of customers income and expenditure. This has been particularly useful given the recent cost-of-living crisis, as more traditional affordability models have failed to keep up to date

- We also regularly see Open Banking used for additional credit risk checks, either through rules or as part of models

One of the key advantages of Open Banking is that it enables lenders to make faster and more reliable responsible lending decisions compared to relying solely on more traditional data sources. This is now more important than ever for lenders given the new Consumer Duty puts a greater focus on good customer outcomes, which we believe includes accurate affordability assessments.

Challenges faced

Despite the clear advantages Open Banking offers, we have also seen challenges along the way.

- In our experience most lenders are still using Open Banking to say ‘no’ to customers, which in most cases reduces risk. However, as always lenders must juggle the commercial trade-off between risk levels and volumes

- Categorising bank account transactions is complex and as a result Open Banking categorisation models are not always accurate, which can lead to bad outcomes

- Integrating Open Banking into existing customer journeys can be difficult and, in some cases, can lead to added friction and customer drop-off

- Data challenges exist. Transaction data can be enormous and time consuming to process. Conversely a lack of data is initially an issue as you cannot retro Open Banking data, so lenders are often learning as they go from their live data feeds

Looking ahead

We are now starting to see lenders utilising Open Banking data for uses over and above assessing affordability, allowing them to leverage the full potential of this data source. Some areas where we expect to see Open Banking grow further are:

- Collections – Open Banking has been predominantly focussed on acquisition strategies, but is now more widely used to provide more accurate and faster I&E assessments in collections, which can be used for more tailored and affordable payment plans

- Income Verification – some Open Banking providers are now offering products that only extract customer credit transactions, allowing for the verification of income only. This can be appropriate for some segments and can lead to higher take up and conversions rates

- Identity Verification – Open Banking can also be used for automated identity verification, which we expect to see more lenders adopting going forward, reducing another potential point of friction in the acquisition journey

- Thin Files – in our experience progress here has been slow. A lack of data to build strategies here is an issue, but as lenders build confidence in their existing Open Banking strategies, we expect them to start using Open Banking to test into this population and build out better thin file strategies and products

- Credit Risk Models – early adopters are now reaching a stage where they have sufficient Open Banking data to build their own credit risk scorecard models with – see the case study below. This is being further accelerated by some aggregator channels adding Open Banking consent at the start of their journeys, enabling pre-approved Open Banking offers

Case Study: The Vestigo Approach

The Client

We recently worked with an established lender who were an early Open Banking adopter. They have built up their Open Banking data over the years and wanted to understand what further value it could bring for credit risk decisioning

1. Data Preparation

Numerous data sources were accessed, extracted, and combined, including application form information, credit bureau feeds, and Open Banking data. The data was cleansed and checked for its accuracy and appropriateness

2. Modelling Process

Several model options were investigated from Logistic Regression to more complex models such as Neural Networks and Random Forests

3. Optimisation & Strategy Setting

The model parameters were fine-tuned and optimised. Strategy analysis was carried out to determine different cut-offs impact on the lender’s profitability

Project Insights

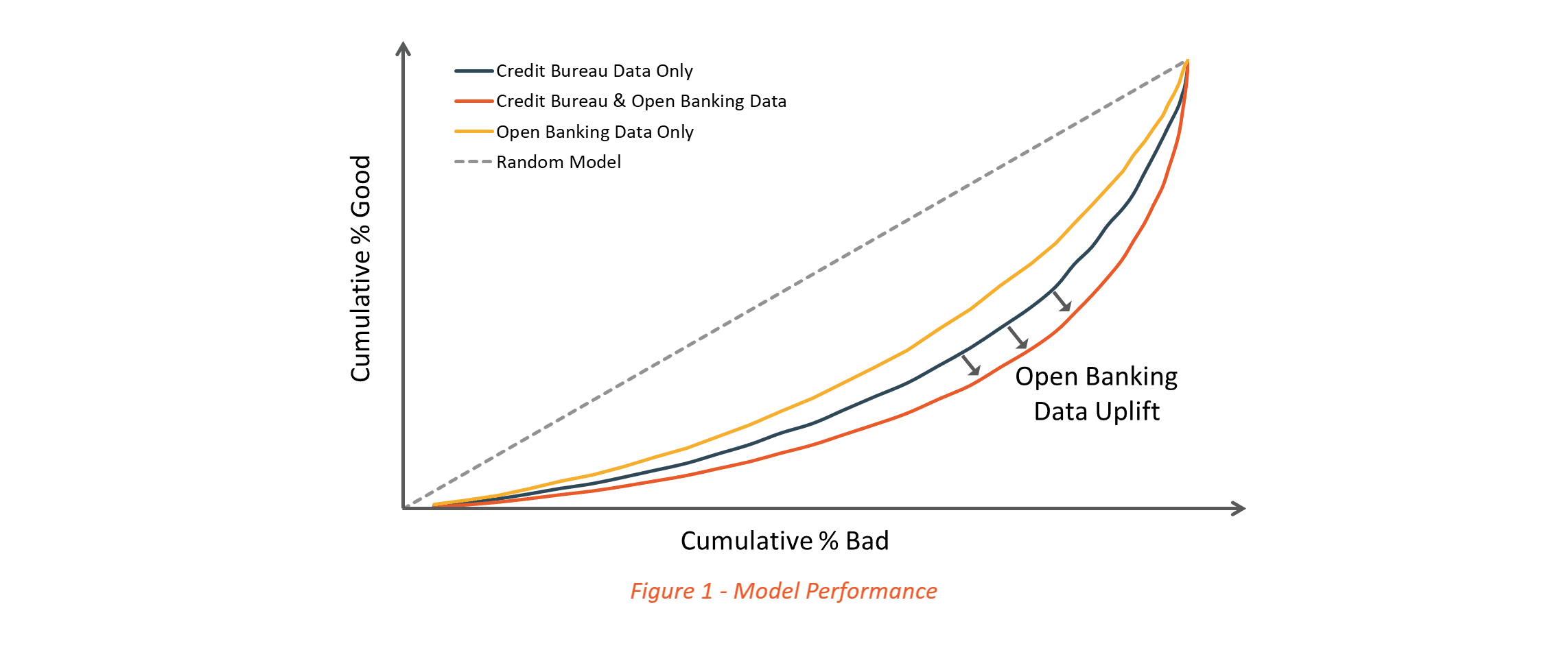

The biggest takeaway from this project was that Open Banking data added significant uplift to existing credit scorecard models when used alongside established credit bureau data points. Using only Open Banking data in the model resulted in a much weaker model compared to using only credit bureau data, although model performance still predicted risk relatively well. The real value however, was in using the two sources of data in tandem.

Many of the Open Banking features that entered the model are ones you would logically expect to predict risk, but crucially are not easily identifiable through traditional data points alone. Some of the most important Open Banking features in our final model were:

- Regular salary income

- Regular overdraft usage or low available balance

- Number of returned payments

- Cash machine withdrawals

- Regular savings

- Gambling transactions

Final thoughts

Open Banking data complements existing data sources and adds significant additional value. It enables faster customer journeys with less operational overhead whilst also giving a more accurate and up to date view of customers money management resulting in improved credit risk decisioning.

At Vestigo, we believe that Open Banking should be one of the core tools in any lender’s arsenal. Lenders that are not currently using Open Banking are lagging their peers and missing out on significant value benefits. While for those that are already using Open Banking, we expect them to further develop, embed, and optimise their Open Banking strategies.

If you are interested in finding out how Vestigo could help your business make the most out of Open Banking data, please get in touch.

Similar news posts

Experienced risk and analytics consultancy

Building analytical solutions that are focused on your real-world objectives

Get the latest news from Vestigo