This website uses cookies for analytics purposes. Learn more

Managing Risk through the Cost of Living Crisis

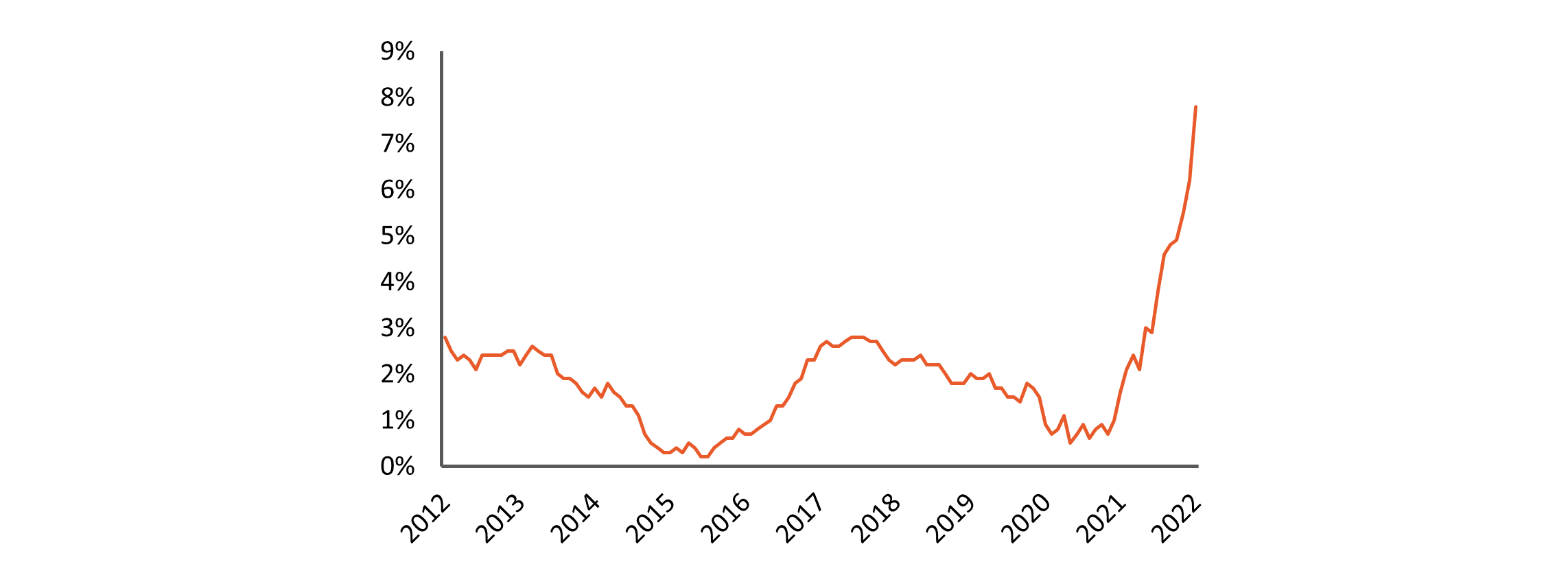

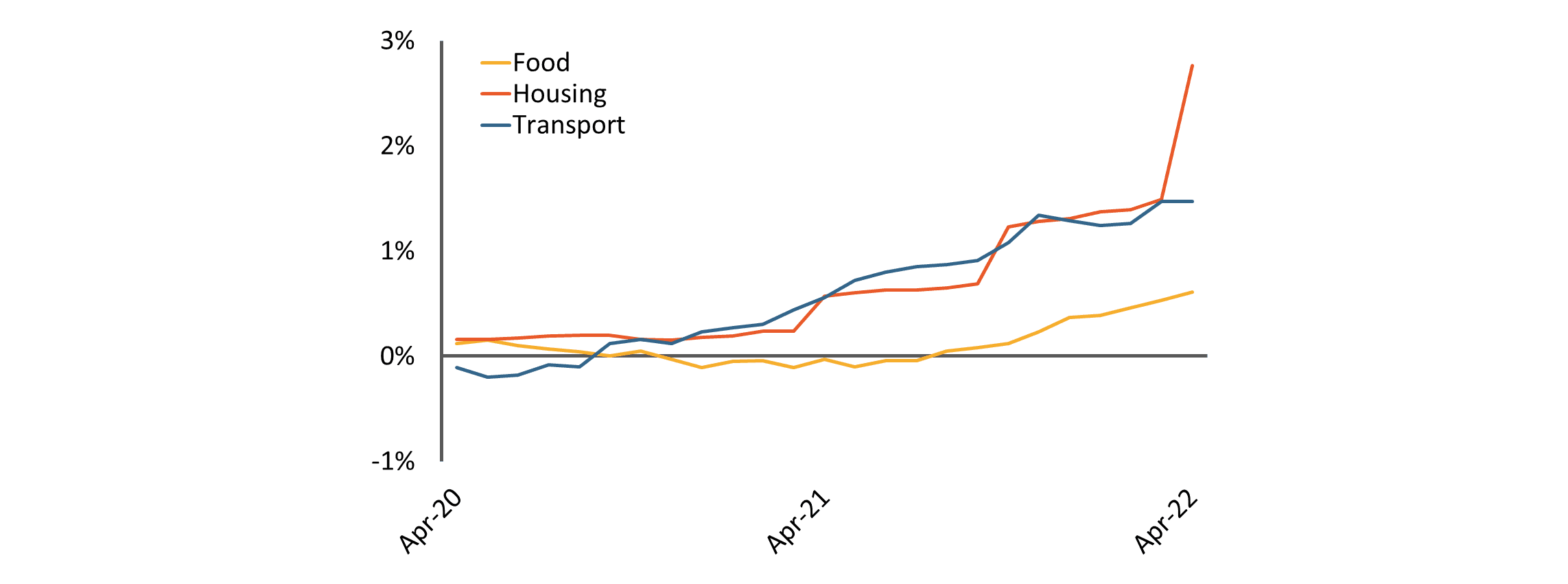

The cost of living is at the forefront of many consumers’ thoughts, with energy prices increasing significantly, as well as the cost of petrol and food continuing to rise. Understandably, with the stress on customers’ pockets expected to last for the foreseeable future, lenders are keen to understand and brace for the impact on their loan books.

The cost of living is at the forefront of many consumers’ thoughts, with energy prices increasing significantly, as well as the cost of petrol and food continuing to rise.

Understandably, with the stress on customers’ pockets expected to last for the foreseeable future, lenders are keen to understand and brace for the impact on their loan books.

Vestigo have been working closely with clients, and while performance has not begun to materially deteriorate yet, we are seeing lenders act quickly to understand and mitigate this phenomenon both for new and existing customers.

How lenders are reacting with new business

Lenders are considering broad changes to underwriting processes, such as policy rule adjustments, pricing optimisation, and increased automation. However, to ensure our clients can continue to lend responsibly, even through this period of increased consumer stress, a key focus point is affordability.

Some of the measures that credit providers are using include:

- Temporarily increasing disposable income buffers

- A quick and simple approach to build operational resilience for short-term future shocks without having to severely restrict lending

- However this approach, while having a clear advantage of speed, is not particularly analytical

- Revisiting individual components of the affordability algorithm

- A more targeted review of each element of the affordability calculation will allow lenders to gain comfort around essential and non-essential expenditure

- Sensitivity analysis of each component will highlight the key drivers that should be updated or stressed going forward

- Utilising insight from other data sources, such as Open Banking will provide the most up-to-date view of customers’ finances in the current climate

- Increasing manual refers in the short-term

- The more stressed or vulnerable group of customers can be pushed into the referral pot in the immediate future, by referring more customers at the boundaries of the lender’s acceptance criteria

- This will help the business to gain further insight into how best to help the customers through the cost-of-living crisis, and ensure borderline cases receive additional attention during this period

What our clients are doing for existing customers

It is not just the affordability of new lending that is put under pressure by the current climate. Credit providers are paying close attention to existing customer circumstances, to ensure adequate support is provided.

We have seen the following initiatives in portfolio and arrears management:

- Assessing and identifying the ‘at risk’ population

- The proportion of the book potentially in negative affordability can be calculated by recalculating affordability based on updated values

- Those in negative affordability would be the most at risk, and could be expected to drive increased arrears, with a knock-on impact for IFRS9 provisions

- Enhancing early indicators and improving arrears reporting:

- Early warning flags, such as the cancelling of direct debits or income shock triggers allow lenders to react quickly to potential financial difficulty

- Analysing arrears performance by the segmentation used in the affordability modelling (e.g. household composition) will help to identify any mismatches, which can be fed back to the underwriting process

- Tracking the mix of customers entering collections and collections performance of early engagement, as well as reporting by industry sector will provide lenders with valuable points of insight

Closing thoughts

Historically, defaults could for the most part be linked to life events, such as unemployment, severe injury or illness, or family circumstances. However, the cost-of-living crisis creates a sustained stress on customer affordability that is unlike those observed in previous recessions. A customer’s ability to mitigate the increase in cost of living month-on-month is dependent on both income and level of savings, so it is vital that lenders focus their efforts on identifying and supporting the most vulnerable individuals.

In time, wage growth should begin to catch up with inflationary pressures. However, this is unlikely to be the case for all sectors, with public vs private sector expected to be a key differentiator for this issue. Whatever happens, recovery will take time, so preparing for this sustained stress is vital.

If you are interested in finding out how Vestigo could help your business adapt to the current environment, please get in touch

Similar news posts

Experienced risk and analytics consultancy

Building analytical solutions that are focused on your real-world objectives

Get the latest news from Vestigo