This website uses cookies for analytics purposes. Learn more

Credit Bureau ‘Sunsetting’: An Opportunity for More Powerful Data

Bureaus have recently accelerated the decommissioning of products due to reviews linked to the new Consumer Duty. We discuss the opportunity this presents to lenders, by prompting a review and refresh of their data and tools.

Credit bureaus provide a vast array of valuable data products and tools. These have been amassed and enhanced over many years, resulting in numerous different versions of the same fundamental product; historic customer credit data being presented in a variety of ways.

These products are integral to many lending businesses and can be heavily embedded into technology and processes, which can often lead to resistance to update within the business. We see a surprising number of lenders who are still using legacy bureau products because of this.

From time to time the credit bureaus will decommission older products, often referred to as ‘sunsetting’. This is usually once the product is very outdated and not as widely used. However recently we are seeing a new occurrence: bureaus decommissioning models accelerated by their new Consumer Duty reviews. For example, models where postcode or household data is used are being sunsetted earlier than they would have been historically, as they do not always lead to good customer outcomes.

Challenge or Opportunity?

For lenders still using products that are soon to be decommissioned, they will be forced to upgrade or use an alternative. This can pose several questions for lenders, and place additional pressure on already stretched credit risk teams, for example:

- Has the impact and cost of a product change been carefully planned for, analysed and signed-off?

- Will the existing strategy or scorecard need to be rebuilt for the new product version?

- Is the current monitoring solution fit-for-purpose and able to account for the effect of the changes?

- Has the data team been engaged to ensure any new variables are stored alongside existing information

- Does the credit risk team have enough available resource to manage implementation of the new version?

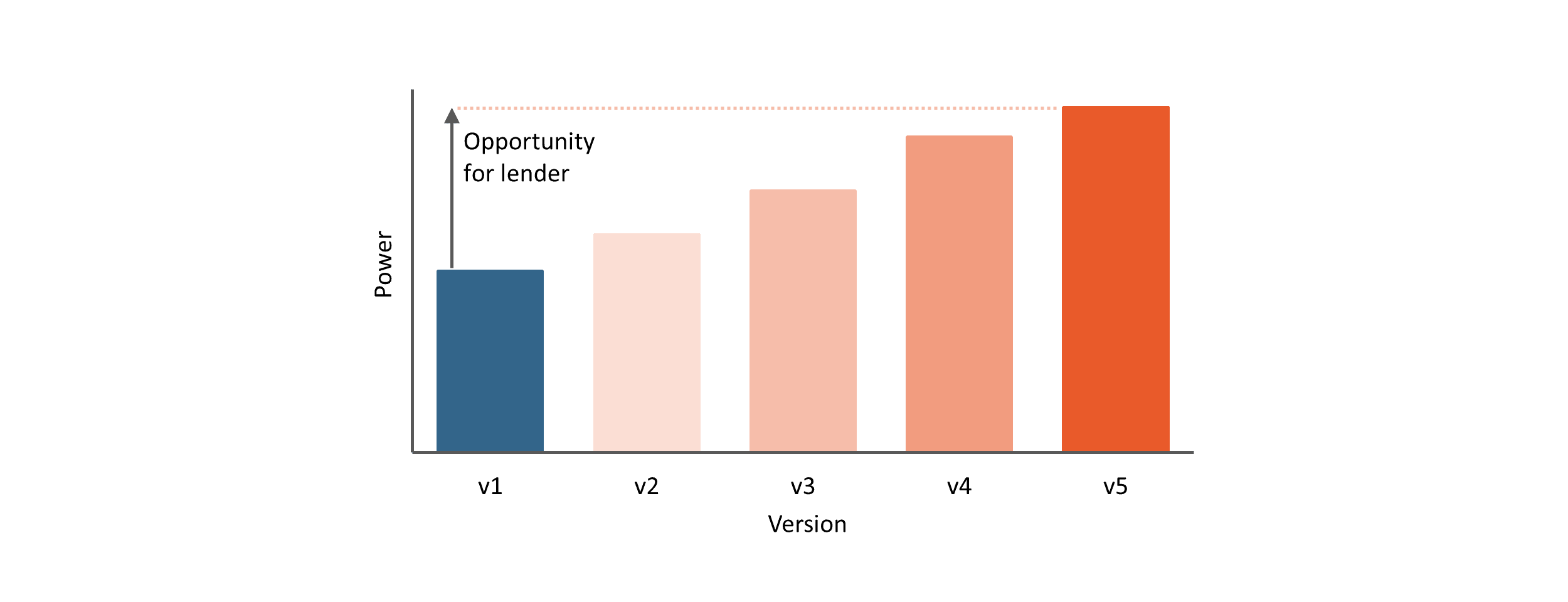

On the other hand, new bureau products can represent a significant opportunity for lenders to review and refresh their use of bureau data, tools, and scores to get the best value out of them. Trended data for example is a recent innovation that we have seen add material uplift to model prediction from bureau data. There have also been notable innovations in affordability assessment and income verification in recent years. The older the version a lender is currently using, the greater the opportunity; each single bureau iteration on its own may only have marginal added benefit, but a combination of several upgrades over multiple years can be very powerful.

We would encourage lenders to grasp the opportunity that may arise from a sunsetting deadline, upgrade any legacy tools and engage with the bureau to fully understand their latest product sets.

If you are a lender impacted by the sunsetting of a product, Vestigo can help you smoothly manage this transition. Please get in touch for more information.

Similar news posts

Experienced risk and analytics consultancy

Building analytical solutions that are focused on your real-world objectives

Get the latest news from Vestigo