This website uses cookies for analytics purposes. Learn more

Mortgages and the Impact of Increasing Interest Rates

The Bank of England has raised the base rate nine consecutive times, taking the rate from 0.1% to 3.5% at the time of writing. In this article we will cover how the rise in interest rates is affecting mortgage holders. We will explore the different ways in which lenders can help their existing customers, as well as how lenders can prepare for new business.

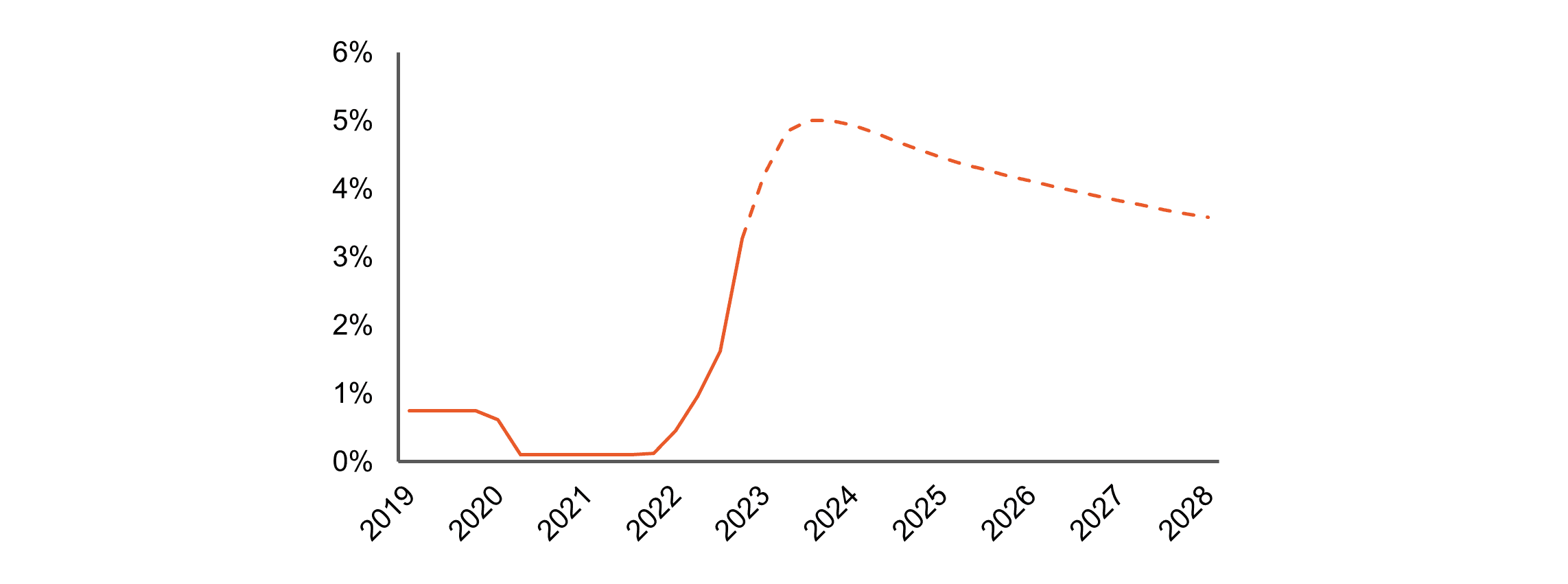

Between December 2021 and December 2022, the Bank of England has raised the base rate nine consecutive times, taking the rate from 0.1% to 3.5% at the time of writing.

This is the highest rate since 2008, and is expected to increase further to at least 4% in the next year to counter high inflation (10%+).

In this article we will cover how the rise in interest rates is affecting mortgage holders. We will explore the different ways in which lenders can help their existing customers, as well as how lenders can prepare for new business.

First, some background: Interest rates had been historically low prior to 2022, following the finanical crisis in 2007/2008 and the COVID-19 pandemic emergency measures in 2020. However, inflation rates are significantly above the Bank’s target, pushing the UK economy towards a recession, and resulting in continual base rate increases.

Mortgage Repayments

Mortgage holders are expected to see rises in their interest rates and monthly payments as a consequence of the base rate increases.

- For variable rate customers this may have already happened, and there may be further increases round the corner.

- For fixed term customers, this will not affect them until their fixed term ends, at which point they will either move onto a variable rate or re-mortgage.

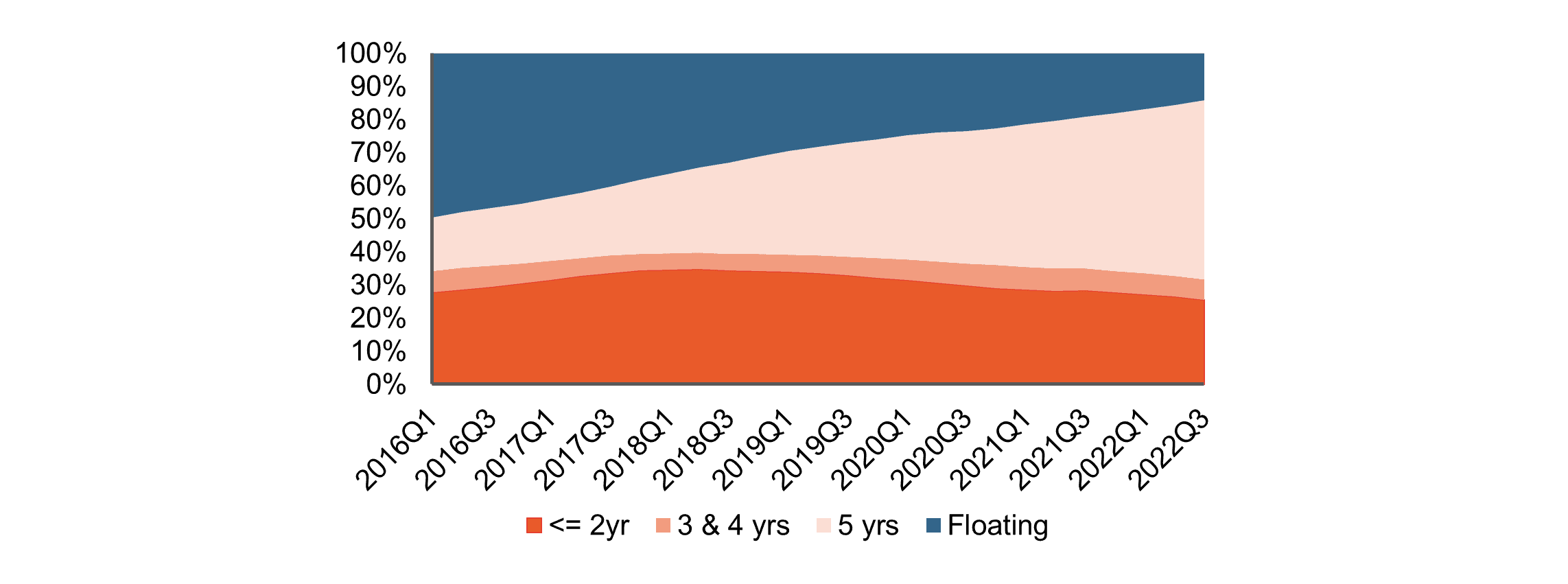

Figures from the Bank of England show that there have been year-on-year increases in the number of fixed rate mortgage deals, with c.50% of active mortgages in 2022 being on a 5-year fixed deal. As such the impact of the increased repayments is expected to be gradual, phasing in as deals expire.

A customer on a 5-year fixed rate of 2.5% on a 25-year £175,000 mortgage has an existing mortgage repayment amount of £785. If they are about to come off this deal and onto a variable rate of 5.5%, the repayment amount would increase by £234 (+ 30%) to £1,019. The Bank of England has estimated around four million households will face an increase within the next year, with the average mortgage payment raising by £250.

Mortgage holders are typically considered lower risk, as they will have undergone vigorous affordability checks in order to be approved for the mortgage in the first place. They are more resilient than the average consumer and are likely to have higher incomes and financial associates to share the burden with, therefore suppressing the impact of rising repayments. For the above example, a joint mortgage would result in each individual paying an extra £117 a month.

What Should Lenders be Doing in Response?

Lenders should consider how the rising interest rates affect both new and existing customers. A key priority should be the affordability assessment and continuing to lend responsibly. The type of lender will determine what actions can be taken, with unsecured lenders having to consider mortgage holders vs non-mortgage holders, and secured lenders having to provide a range of options to support customers with payment difficulties. This month the FCA published draft guidance to firms on this subject.

For New Business some of the possible measures are to:

- Adjust the mortgage payment in the affordability assessment

- The mortgage component of the lender’s affordability strategy can be stressed to use a higher value in line with an expected increase. Some assumptions will have to be made around what this expected increase will be vs the existing payment. Additional data can be captured at the application stage to inform this, such as current mortgage deal end date.

- Introduce Open Banking

- Open Banking allows lenders to take a deeper look into a customer’s current financial circumstances, enabling them to get a more accurate view of a customer’s mortgage repayments and whether they have recently changed. A more accurate affordability assessment can also be derived from Open Banking.

For Existing Customers possible actions to take as a result of increasing stress on mortgage holders are to:

- Utilise monthly bureau data

- Lenders can derive an updated mortgage repayment value as well as information on a customer’s recent behaviour. This includes any additional unsecured borrowing or recent arrears, which could indicate an increase in potential financial difficulty.

- Assess and quantify the impact

- There is the possibility of customers tipping over into negative disposable income when affordability is recalculated using the higher mortgage repayment amount. Sizing this can inform any increasing risk in the portfolio and feed into stress testing.

- Offer forbearance

- For customers who have moved into an unaffordable position, lenders can offer forbearance options to help. This includes payment plans, payment holidays, term extensions or switching to interest only. For interest only switching, a temporary move as part of forbearance should not require a lender to have evidence of a repayment strategy.

- Provide Interest Only deals

- Mortgage lenders could offer an Interest Only deal to customers who would be pushed into an unaffordable position when their existing deal ends. This reduces the customer’s monthly repayment, however as the overall capital does not decrease over time the customer would still have to find a way of paying this back later. From a lender perspective moving a loan from Repayment to Interest Only could have significant implications on provisioning, capital and any funding covenants so should be carefully understood before commencing this approach.

Vestigo have recently been working with a number of lenders to help them understand the impact of this changing environment and support them to adapt their strategies to ensure responsible lending. Although the full effect of the rise in rates is expected to be gradual as customers come off fixed rate deals, it is vital for lenders to prepare for this and support customers who have been affected.

If you are interested in finding out how Vestigo could help your business, please get in touch.

Similar news posts

Experienced risk and analytics consultancy

Building analytical solutions that are focused on your real-world objectives

Get the latest news from Vestigo